TAX DEDUCTED AT SOURCE

Understanding Tax Deducted at Source (TDS)

Introduction

Welcome to our comprehensive guide on Tax Deducted at Source (TDS). TDS is a mechanism employed by the Indian government to collect taxes at the source of income generation. In this section, we will provide you with valuable insights into TDS, its applicability, calculation, rates, compliance requirements, and more.

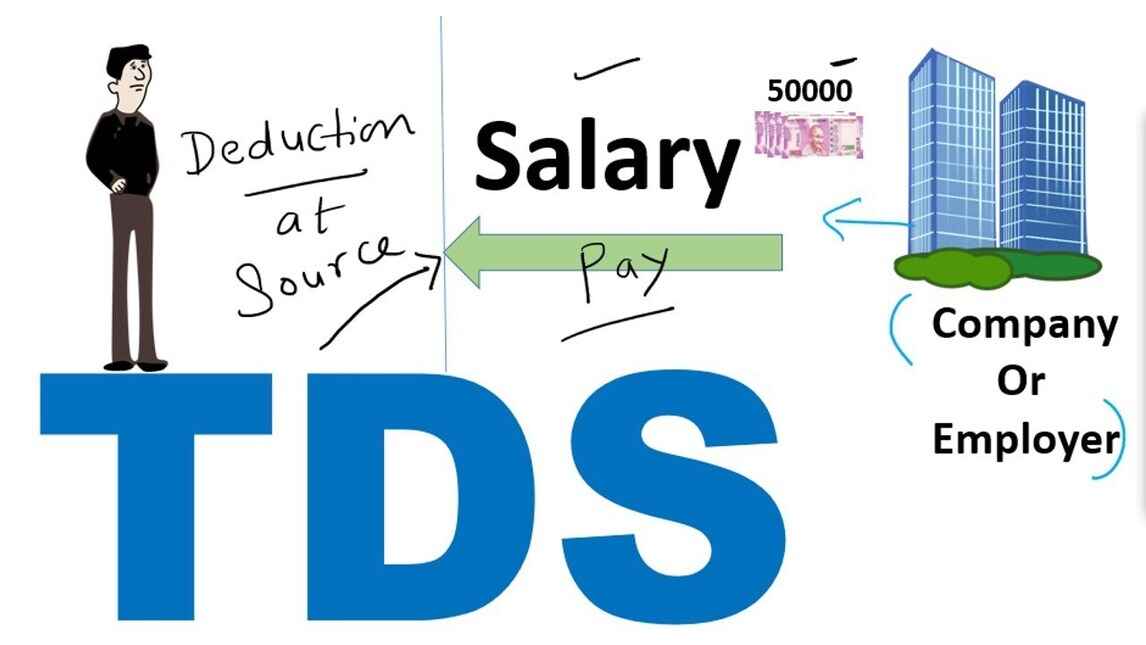

What is TDS?

Tax Deducted at Source (TDS) is a system where a specified percentage of tax is deducted by the payer at the time of making certain payments, such as salary, interest, rent, professional fees, etc. The deducted amount is then deposited with the government on behalf of the payee.

- Introduction to Tax Deducted at Source (TDS)

- Purpose and Significance of TDS in the Indian Tax System

- Key Entities Involved in TDS: Deductor, Deductee, and Income Tax Department

Applicability of TDS

Discover the various scenarios where TDS is applicable. We will explain the types of payments and transactions that attract TDS, such as salaries, interest income, contractor payments, and more. Understanding the applicability of TDS will help you ensure compliance with tax regulations.

- Types of Payments Subject to TDS

- Threshold Limits for TDS Applicability

- Exemptions and Exceptions to TDS

TDS Rates and Thresholds

Learn about the TDS rates and thresholds for different types of payments. We will provide you with a detailed overview of the TDS rates applicable to various income categories, ensuring you understand the percentage of tax that needs to be deducted at the source.

- TDS Rates for Different Payment Categories

- Slabs for TDS Deductions on Salary Income

- TDS Rates for Non-Salary Payments

- Special TDS Rates and Provisions

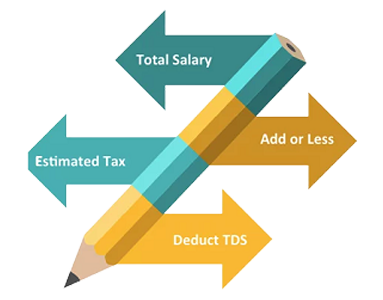

TDS Deduction and Calculation

Understand the process of TDS deduction and calculation. We will guide you through the steps involved in determining the TDS amount, considering the applicable rates, exemptions, and deductions. Gain clarity on how to calculate TDS accurately to meet your tax obligations.

- Obligations of the Deductor: Deduction and Remittance of TDS

- Responsibilities of the Deductee: Receiving TDS Certificates

- TDS Filing and Return Procedures

- Due Dates for TDS Payment and Return Filing

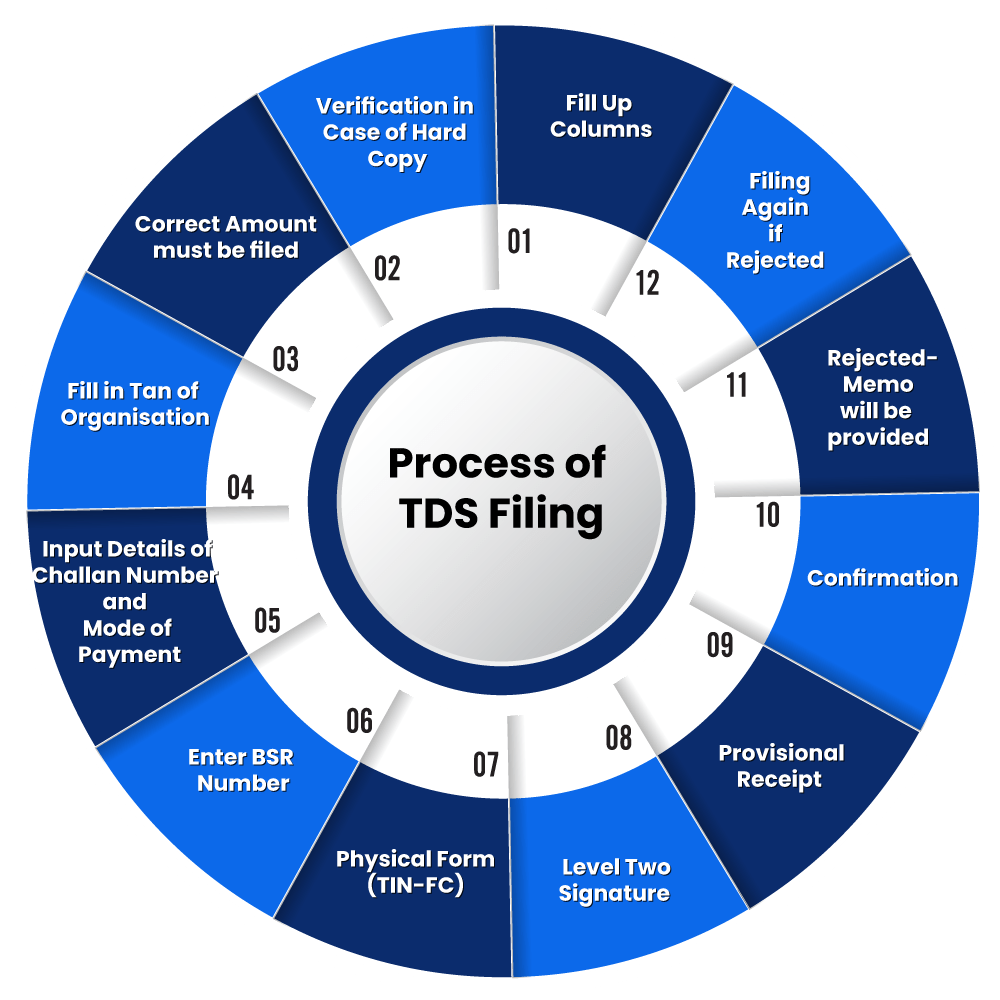

TDS Return Filing

Get insights into the TDS return filing process. We will explain the TDS return forms, due dates, and the procedure for filing TDS returns online. Understanding the TDS return filing requirements will help you fulfill your compliance obligations with ease.

TDS Certificates

Learn about the TDS certificates that are issued to deductees. We will explain the different types of TDS certificates, such as Form 16, Form 16A, and Form 16B, and their significance. Understanding TDS certificates will enable you to validate the TDS deductions made on your income.

- Form 16: Understanding the TDS Certificate for Salary Income

- Other TDS Certificates: Form 16A, Form 16B, Form 16C, and Form 16D

TDS Compliance and Penalties

Discover the compliance requirements and penalties related to TDS. We will provide insights into the consequences of non-compliance, including interest charges, penalties, and prosecution. Understanding TDS compliance will help you avoid unnecessary penalties and maintain a good tax record.

Frequently Asked Questions (FAQs)

Access our curated list of frequently asked questions about TDS. Find answers to common queries related to TDS applicability, rates, compliance, and more. Our FAQ section aims to address your concerns and provide clarity on TDS-related matters.

- Common Queries about TDS and their Answers

- Expert Insights on TDS-related Matters

Conclusion

This comprehensive guide aims to simplify the concept of Tax Deducted at Source (TDS) in India. Understanding TDS applicability, rates, calculation, compliance, and related aspects is crucial for individuals and businesses. Stay informed and compliant to fulfill your TDS obligations and ensure smooth financial operations.

Expert Guidance: Find Your Perfect Service Provider

Happy to Serve Support Team