INCOME TAX

Understanding the Indian Income Tax System

Introduction

Welcome to our comprehensive guide to the Indian income tax system. Whether you're an individual taxpayer or a business owner, understanding how income tax works in India is crucial for effective financial planning. In this guide, we'll cover the key concepts, rules, and regulations related to income tax in India.

What is Income Tax?

Income tax is a direct tax levied on the income earned by individuals, businesses, and other entities. It is a significant source of revenue for the government and is governed by the Income Tax Act, 1961. The Act defines various terms, provisions, and rules that determine the computation and payment of income tax.

Income Tax Slabs and Rates

The Indian income tax system follows a progressive tax structure, where tax rates increase with higher income levels. We provide an overview of the current income tax slabs and rates in India, helping you determine your tax liability based on your income bracket. It's important to understand how these tax slabs work to effectively plan your finances.

Tax Deductions and Exemptions

The Indian income tax system provides several deductions and exemptions that can help reduce your taxable income. We explore popular tax deductions available to individuals, such as Section 80C, which covers investments like Provident Fund (PF), Public Provident Fund (PPF), and Life Insurance Premiums. We also explain exemptions for house rent allowance (HRA), leave travel allowance (LTA), and more. Understanding these deductions and exemptions can significantly lower your tax burden.

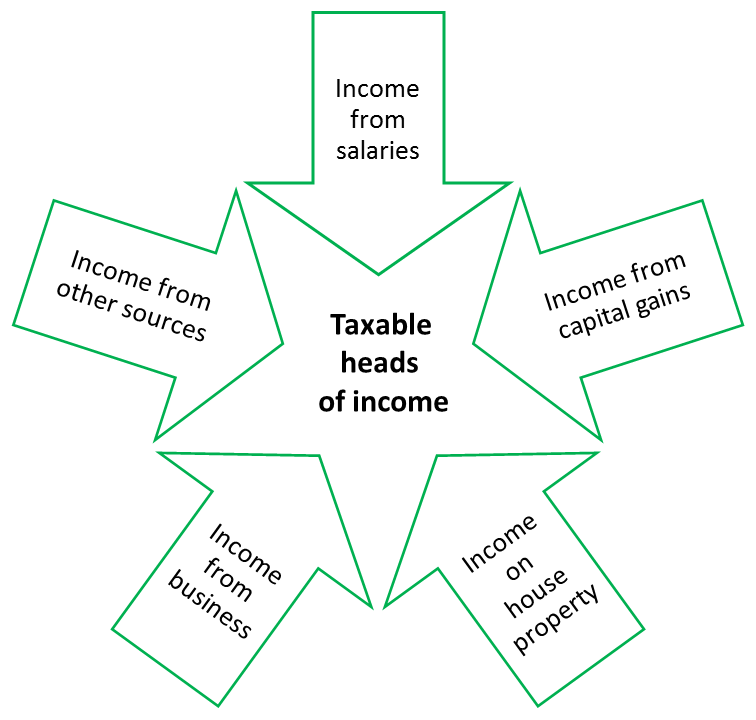

Income from Different Sources

Income tax applies to various sources of income, including salary, rental income, and capital gains. We delve into the tax implications of these income sources, explaining how salary components affect tax calculations, rules for taxing rental income, and the taxation of capital gains from investments and property. Knowing how different sources of income are taxed can help you plan your finances accordingly.

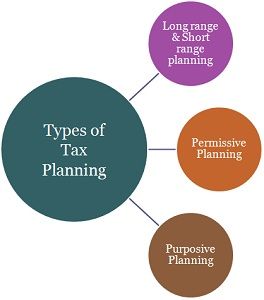

Tax Planning and Investments

Effective tax planning can help optimize your tax liability. We discuss tax-saving investment options available in India, such as Equity-Linked Savings Schemes (ELSS), Public Provident Fund (PPF), and National Pension Scheme (NPS). We also explore long-term capital gains and the benefits of indexation. By strategically investing in tax-saving instruments, you can reduce your taxable income and maximize your savings.

Filing Income Tax Returns

Filing income tax returns is a mandatory requirement for individuals and businesses. Our step-by-step guide to e-filing income tax returns in India walks you through the process, ensuring compliance with deadlines and providing tips to avoid common mistakes. We also highlight different Income Tax Return (ITR) forms and help you choose the appropriate one for your income sources.

Tax Compliance and Deadlines

Staying compliant with income tax regulations is essential. We provide a list of important dates for income tax filing and payment to help you stay organized. We also discuss compliance requirements for individuals and businesses, along with penalties and consequences for non-compliance. Understanding these compliance obligations can help you avoid legal issues and penalties.

Taxation for NRIs

For non-resident Indians (NRIs), there are specific tax implications to be aware of. We discuss the tax rules and provisions applicable to NRIs, including income sources, exemptions, and filing requirements. We also highlight how to avoid double taxation by leveraging tax treaties and foreign tax credits.

Expert Guidance: Find Your Perfect Service Provider

Happy to Serve Support Team